Using the newest technologies is often necessary to keep ahead in the world of personal finance. You have to know which laws and ethical implications are in the news, pay your taxes on time, and even coordinate with your family or peers to sort out your finances. Of all these developments,

Financial Digital Planners are particularly useful for people who want to organize and take charge of their financial destiny.

Read on to find out more about the state of financial digital planners now and speculate on the possibilities for these instruments going forward. With technology evolving day by day, what advancements can we expect from our digital planners? Keep reading to find out answers to this and much more.

Understanding Digital Financial Planner

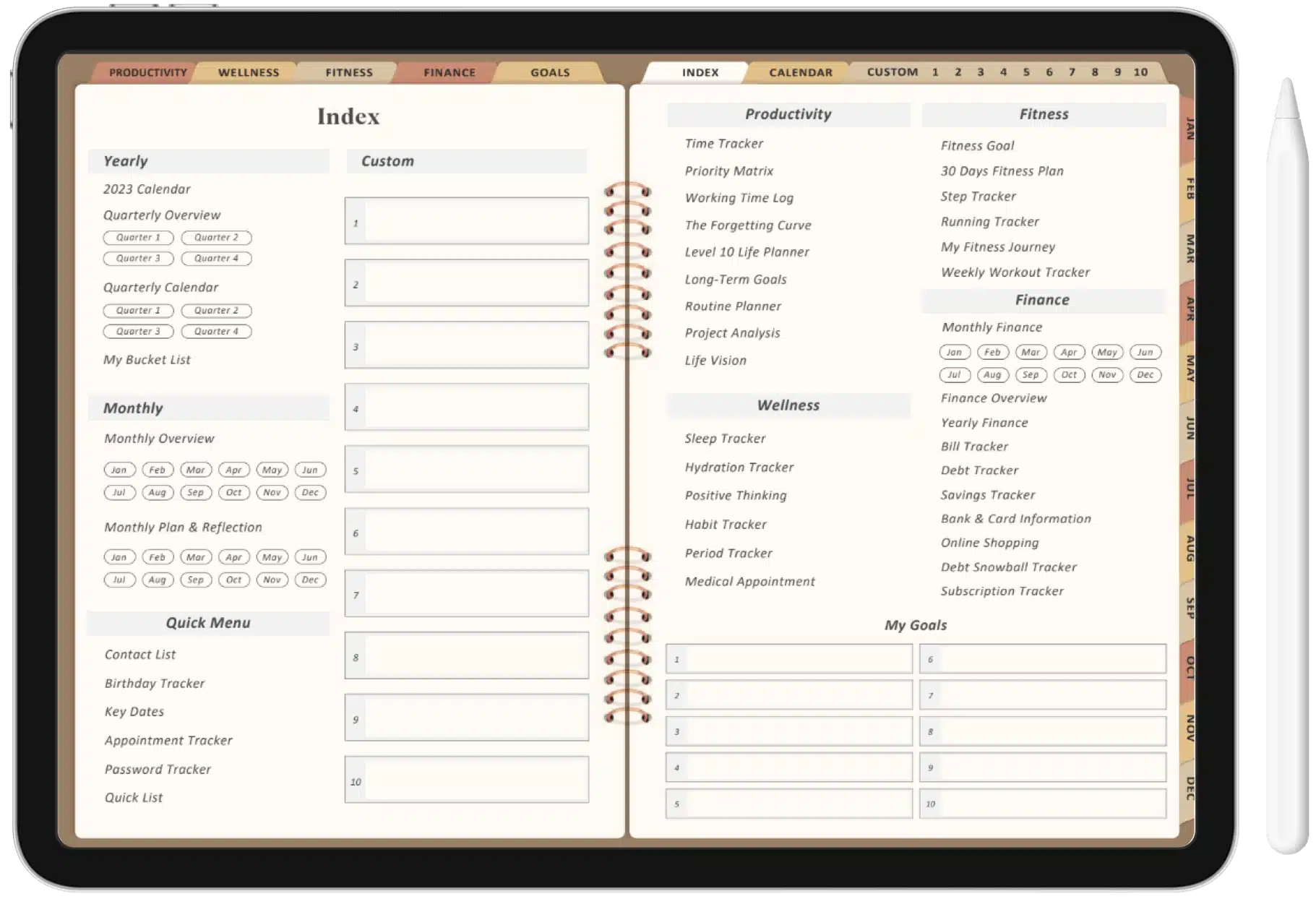

Applications or online software known as digital financial planners are made to help people manage their money more effectively.

They function as all-inclusive tools for goal-setting, tracking spending, creating budgets, and even investing. To give users a comprehensive picture of their financial health, these planners frequently interface with a variety of financial accounts.

Digital planners are beneficial since they make financial management procedures more efficient. Through the automation of processes like bill payment and expense classification, these solutions help users save a significant amount of time.

They also provide reports and visualizations that provide insights, enabling consumers to make well-informed financial decisions.

Planners are a great tool for helping students start good financial habits at a young age. Through the provision of transparent spending trends and customized budgeting features, these planners furnish students with crucial money management competencies for their future.

Financial planners are very beneficial to working professionals. They frequently find it difficult to maintain organization due to their hectic schedules and numerous financial commitments.

As virtual assistants, these planners review impending bills, evaluate potential investments, and maximize savings plans.

These planners are valuable even for retirees as they concentrate on asset management, retirement planning, and withdrawal techniques to ensure peace of mind in later life.

The Future of Financial Digital Planners

The future of financial planners holds exciting new advancements and improvements as technology progresses. Here are some significant elements and patterns to look out for:

Artificial Intelligence and Machine Learning

Financial planning is already growing quickly thanks to AI and ML advancements. In the future, we can expect them to be integrated into digital planners to enhance their applications. This will help the tools analyze large amounts of data that is entered by users and advise them using personalized insights.

AI and ML algorithms are sure to help users by offering suggestions based on their prior actions and preferences.

With time, these algorithms can learn from user behavior, spotting patterns and trends. It will allow them to provide individualized advice on risk management, investing strategies, and budgeting. Let’s take an example where a user routinely overspends on eating out.

This tendency can be identified by an AI-powered planner, which can also offer doable alternatives. It could include limiting eating expenditures or recommending other restaurants that are more in line with the user’s financial objectives.

Blockchain Integration

An additional frontier in the development of the best digital planners is represented by blockchain technology. Financial planning platforms could change their operations as a result of the integration of blockchain technology, which is gaining momentum in the field of decentralized finance (DeFi).

These planners can also ensure peer to peer transactions safely without the need for middlemen. You don’t need banks or payment processors once you start using modern blockchain technology.

You can be sure of financial integrity and lowered transaction costs. It also improves transparency and immutability in your transactions to give you good peace of mind.

Moreover, smart contracts enabled by blockchain technology can automate various financial procedures. This includes investment transactions, insurance claims, and loan approvals.

The self-executing contracts function according to predetermined criteria, diminishing the necessity for human involvement and optimizing administrative procedures.

Gamification and Behavioral Economics

These planners incorporate gamification features, such as achievements, progress indicators, and awards, to make financial management more engaging and entertaining.

For example, users may receive badges or points for reaching savings targets, adhering to spending plans, or finishing financial literacy courses.

In addition to offering intrinsic motivation, these awards give consumers a feeling of achievement and advancement. They get to remind themselves to take breaks or treat themselves just as much as they are reminded to get their tasks done.

This makes them feel like they are moving forward and motivates them to stick to their budgetary goals.

Furthermore, financial digital planners can be designed with behavioral economics in mind to encourage users to make better decisions. Users can overcome common cognitive biases and make better decisions by, for instance, integrating visual cues to highlight the long-term benefits of financial planning or incorporating default settings for savings contributions.

Integration with Virtual Assistants and Voice Technology

Users can manage their accounts using natural language commands by connecting easily with virtual assistants such as Siri, Alexa, and Google Assistant.

This eliminates the need for manual input or navigating intricate interfaces. Voice technology allows users to engage with their planners hands-free, saving time and effort when checking account balances, organizing bill payments, or setting financial objectives.

Additionally, voice technology improves accessibility for people who would rather engage audibly than through standard visual interfaces, such as individuals with disabilities.

Financial Digital Planners cater to a wide range of user preferences and guarantee inclusivity by offering different channels for participation.

Social Collaboration and Sharing

Making it easier for family members to coordinate their financial efforts is one of the main advantages of social collaboration features.

For instance, parents can establish joint budgets with their kids, imparting to them sound money management skills and forming responsible financial habits at an early age.

In a similar vein, spouses can work together to manage household finances by keeping tabs on spending, establishing savings targets, and overseeing investments.

Digital financial planners foster financial harmony and improve family ties by offering a centralized platform for collaboration and communication.

Social collaboration capabilities may also make it easier to connect with advisors and financial professionals on the platform, in addition to peer help. Consumers seeking individualized counsel, investment advice, or retirement planning services can interact with qualified experts.

Users can improve their financial strategy, make better judgments, and confidently handle challenging financial situations by using the experience of financial experts.

Through these interactions, we can close the gap between users and financial experts to ensure that access to professional advice is democratized. It will help people make better and faster financial decisions in the future.

Environmental, Social, and Governance (ESG) Investing Tools

People are always looking for investments that support global social impact. Today’s modern financial planners tend to add these investments to their monthly or yearly plans as the knowledge available to them grows.

To be in tune with this, financial planners give customers a chance to filter their assets according to social issues and environmental sustainability by integrating ESG investing tools.

By giving consumers access to information about the ESG performance of funds and corporations, these tools enable users to make well-informed decisions that align with their moral and financial values.

ESG investing tools enable users to match their investment portfolios with their beliefs and make a positive impact on a more sustainable and equitable future.

This can be done using something as simple as avoiding investments in fossil fuels or supporting renewable energy initiatives.

This means that in an indirect yet powerful way, your digital planner is working to promote diversity and inclusion. These are big terms for the future that a lot of millennials are eager to be a part of.

Conclusion

Financial digital planners have a bright future ahead of them since technology is about to change the way people handle their money.

These technologies will continue to empower users at every stage of life, from retirees protecting their financial legacy to students managing their first budgets, thanks to AI-driven insights and blockchain-powered transactions.

One thing is certain as we adopt these innovations. Achieving financial wellness will be easier, more interesting, and more fulfilling than in the past. And that is exactly what the aspirants of tomorrow are looking for !

Hey there! I’m Megan Taylor, an entrepreneur with a fire in my belly for using technology to change the game. I’m passionate about launching ventures that make a real impact, and I’m always on the lookout for the next big thing in digital innovation.

What gets me going?

- Building Businesses: I love the thrill of taking an idea and turning it into a reality. From crafting strategies to watching a business flourish, the journey is what excites me.

- Tech Transformation: Technology is constantly evolving, and I find it fascinating to explore how it can revolutionize different aspects of our lives.

- Smart Solutions: Give me a problem, and I’ll find a tech-powered solution! I’m drawn to gadgets and apps that can simplify our daily routines and empower us to do more.

Why You’re Here:

If you’re looking for insights on the latest tech trends, reviews of ingenious gadgets, or tips on using apps to streamline your life, you’ve come to the right place. I love to share my knowledge and experiences, and I’m always eager to connect with fellow tech enthusiasts.

Let’s Explore Together!

Whether you’re a seasoned entrepreneur or just starting your digital journey, I invite you to join me on this adventure. We can discuss the latest tech breakthroughs, share tips and tricks, and explore how technology can help us build a better future.

Feel free to browse my articles, leave comments, and connect with me on social media. Here’s to pushing boundaries, embracing innovation, and using technology to make a positive impact!